29.07.2022

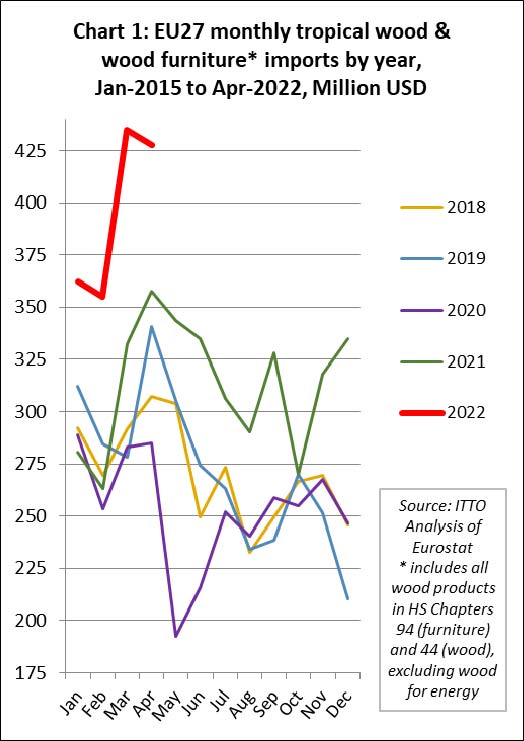

In the first four months of this year, the value of EU imports of tropical wood and wood furniture totalled USD 1.23 billion, a gain of 28% compared to the same period last year. We share with you information from the latest ITTO tropical timber market report (July 15 2022).

In terms of value, this was by far the highest level of trade for the four month period in the last five years (Chart 1). In fact trade value was at a level not seen since before the 2008-2009 financial crises.

Part of the gain in EU27 tropical wood product import value in the first four months of this year reflected a rise in CIF prices, driven both by continuing high freight rates and severe shortages of wood and other materials due to

logistical challenges during the global pandemic.

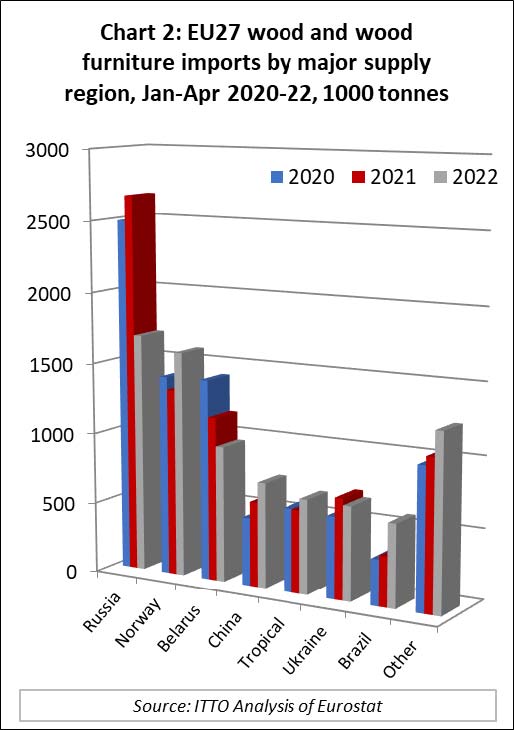

In quantity terms, EU imports of tropical wood and wood furniture products in the first four months of this year were, at 669,000 tonnes, up 14% compared to the same period in 2021.

The curtailment of wood supplies from Russia and Belarus due to the sanctions imposed by the EU following the invasion of Ukraine in February is opening up new opportunities in the EU market for some tropical wood products, notably plywood and decking for which Russian birch and larch products have been important substitutes.

In the first four months of this year, tropical products accounted for 8.2% of the quantity of all wood and wood furniture products imported into the EU27, which compares to 6.9% during the same period in 2021. The gain in tropical wood share is due mainly to a 37% and 17% reduction in imports respectively from Russia and Belarus during this period.

However, larger beneficiaries of the opening supply gap so far this year have been Norway, China and Brazil (nontropical products only).

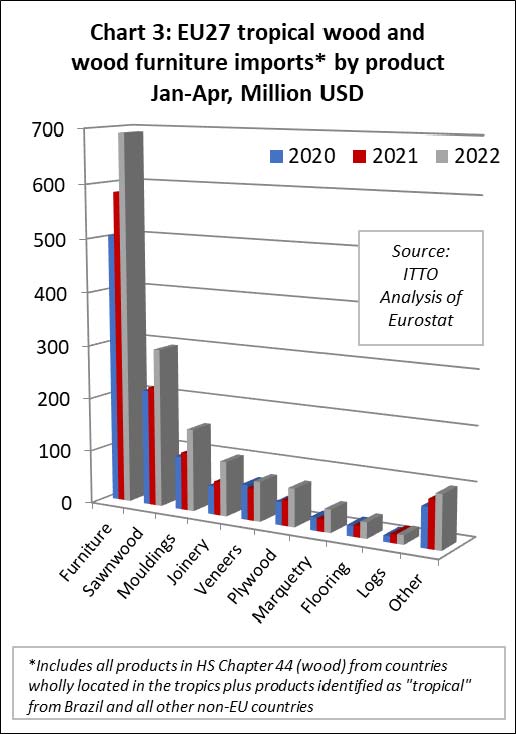

Rise in EU27 import value for nearly all tropical wood product groups

There were significant increases in the value of EU27 imports of most wood product groups from tropical countries in the first four months of this year.

For wood furniture, import value of USD691M during the January to April period was 18% more than the same period last year. For tropical sawnwood, import value of USD297M was 33% up on the same period last year. Import value of tropical mouldings/decking was USD154M in the first four months of this year, a gain of 42% compared to the same period in 2021.

There were also large gains in the value of EU27 imports of tropical joinery products (+63% to USD102M), tropical veneer (+24% to USD74M), plywood (+50% to USD71M), marquetry (+88% to USD43M) and flooring (+40% to USD30M) in the first four months of this year. Import value of tropical logs was USD17M between January and April, just 9% more than the same period last year.

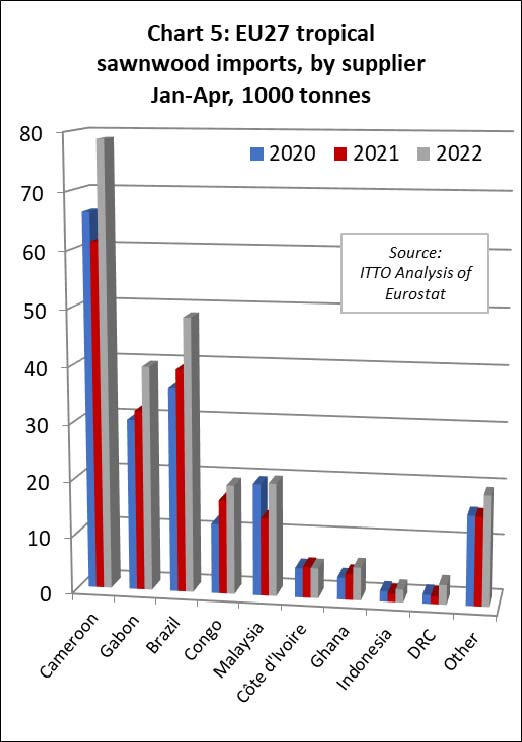

Recovery in EU27 imports of tropical sawnwood

After two slow years during the global pandemic, EU27 imports of tropical sawnwood have shown signs of recovery this year. Imports of 243,000 tonnes in the first four months were 18% higher than the same period in 2021 and 37% more than the same period in 2020.

Sawnwood imports increased sharply in the first four months of this year from all the largest tropical suppliers to the EU27 including Cameroon (+28% to 78,700 tonnes), Gabon (+24% to 39,700 tonnes), Brazil (+23% to 48,500 tonnes), Congo (+16% to 19,400 tonnes) and Malaysia (+46% to 20,000 tonnes).

Of smaller supply countries, there was 3% decline from Côte d'Ivoire to 5,300 tonnes but a 27% increase from Ghana to 5,800 tonnes and a 155% increase from DRC to 3,500 tonnes.

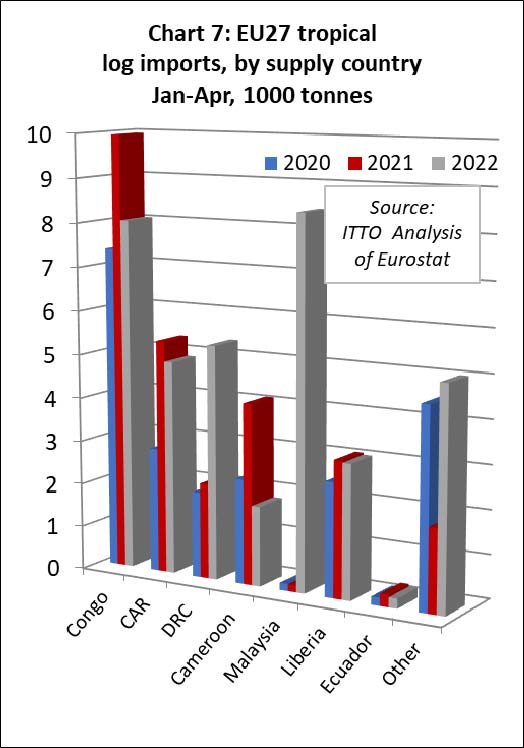

In the first four months of 2022, the EU27 imported 36,900 tonnes of tropical logs, 36% more than the same period in 2021. The most significant trend was a rise in log imports from Malaysia, at negligible levels for many years, to 8,400 tonnes in the first four months of this year.

The rise coincides with a limited export program by the Malaysian State of Sabah allowing eligible parties to export unprocessed timber from natural forests which began on 3 January this year.

EU27 log imports from the largest African supply countries declined in the first four months of this year compared to the same period last year; imports were down 19% to 8,000 tonnes from Congo, down 9% from CAR to 4,900 tonnes, and down 56% from Cameroon to 1,800 tonnes.

However, imports from DRC increased 145% to 5,400 tonnes. Imports from Liberia were level at 3,100 tonnes during the four month period.

Gabon drives rebound in EU27 imports of tropical veneer and plywood

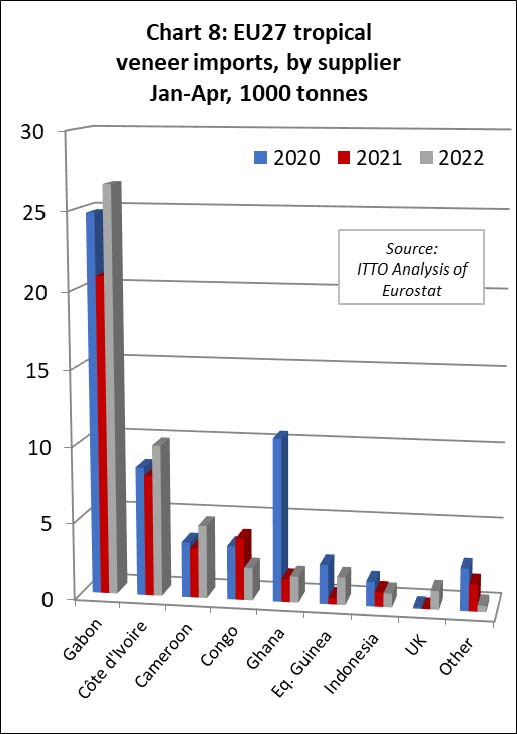

In the first four months of 2022, the EU27 imported 49,500 tonnes of tropical veneer, 22% more than the same period last year. Imports of tropical veneer from Gabon, by far the largest supplier to the EU27, increased 28% to 26,600 tonnes. There were also large gains in imports from Côte d'Ivoire (+26% to 9,900 tonnes) and Cameroon (+47% to 4,700 tonnes), offsetting a sharp decline in imports from Congo (-46% to 2,100 tonnes).

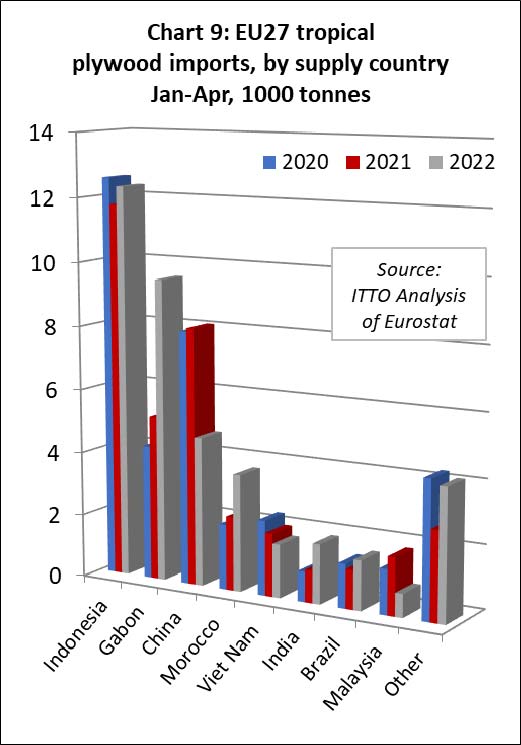

In the first four months of 2022, EU27 tropical plywood imports of 40,200 tonnes were 11% more than the same period the previous year. Imports from Indonesia, at 12,300 tonnes, were up 5% compared to the same period last year.

However, the biggest increase was in imports from Gabon, rising 84% to 9,500 tonnes. Imports of tropical plywood also increased 58% to 3,700 tonnes from Morocco. These gains offset a 42% decline in imports of tropical hardwood faced plywood from China to 4,700 tonnes.

Source : ITTO 15 July 2022